Public Clarification on Tax Invoices: VATP006

All the public clarifications issued by the Federal Tax Authority aim to ensure that the tax system is implemented in the most transparent and people-friendly way. The clarification on Tax Invoices VATP006 discusses the contents of the tax invoice and the situation in which the tax invoice should be issued.

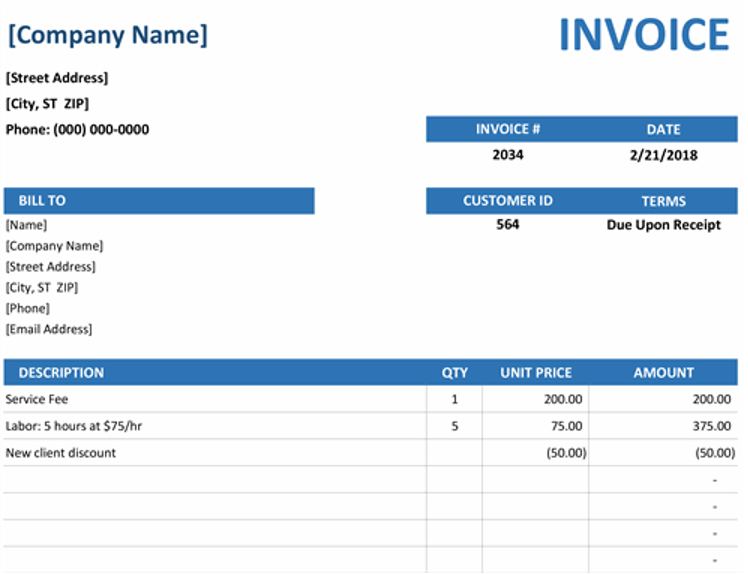

What is an Invoice?

Invoices serve as legally enforceable agreements between a business and its clients, as they provide documentation of services rendered and payment owed. Invoices also help businesses track their sales and manage their finances.

Requirement of a Tax Invoice

The most significant concept in the Tax invoice clarification issued according to the Article 59 of cabinet decision no 52 of 2017 on Executive Regulation of Federal Decree Law no (8) of Value Added Tax is that whether the taxable person is issuing full tax or the simplified tax invoice.

The Four parts of Public Clarification

- Full Tax Invoice Requirement

- Simplified Tax Invoice Requirement

- Tax Invoices Issued in Foreign currency

- Rounding off of Tax Invoice Values

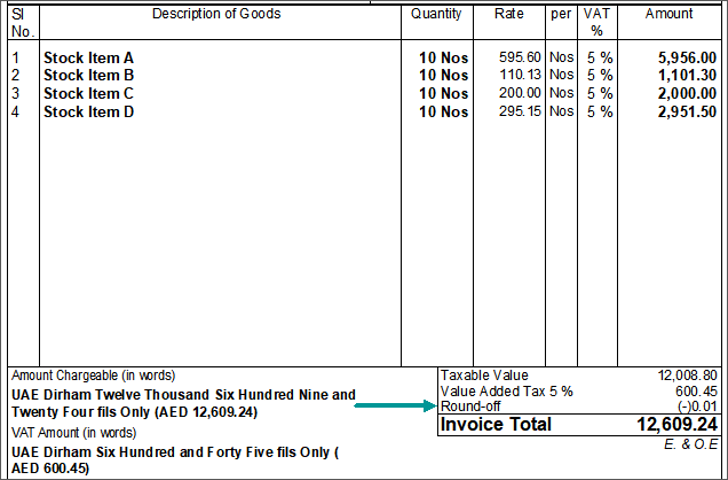

1. Full Tax Invoice Requirement

In a full tax invoice, it is mandatory to show the total gross amount payable expressed in (AED) and not required to show the gross value. The items to be included in a full tax invoice are the following.

- The Unit Price

- The quantity Or Volume Supplied

- Tax rate

- Total Gross Amount expressed in AED

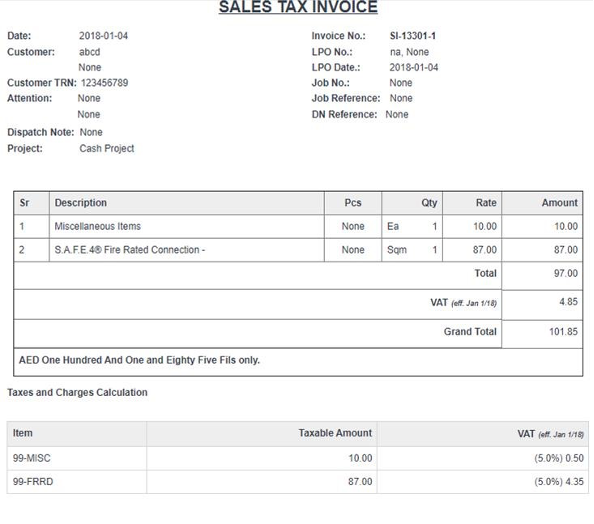

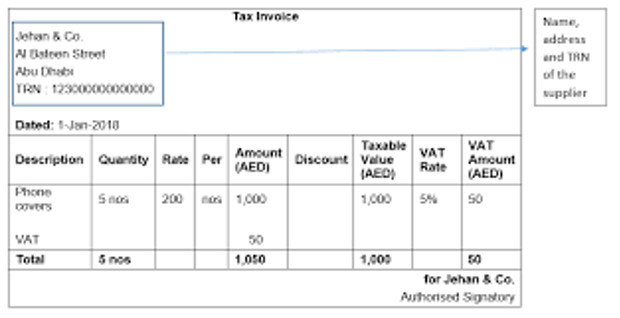

2. Simplified Tax Invoice Requirements

In a simplified tax invoice, the line items have to be shown at the gross value, and no requirement of line items should be shown as net value. Also, in a simplified tax invoice, the total gross value is shown in a separate line showing the tax included within that value. The items to be included in simplified tax are the following.

- The words ‘Tax Invoice’ should be clearly displayed on the invoice.

- The name, address, and Tax registration number of the supplier.

- The date of issuing the tax invoice.

- Description of goods or services supplied.

- The total consideration and tax amount charged.

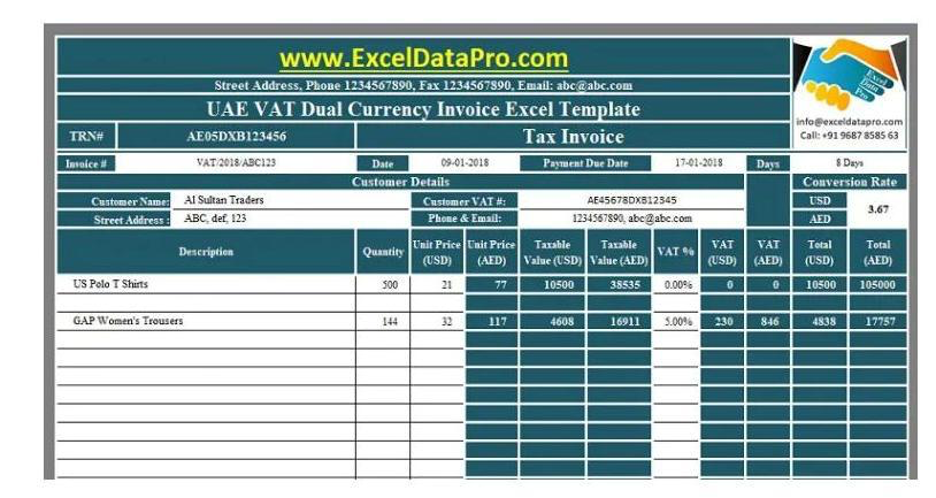

3. Tax invoices Issued In Foreign Currency

If the tax invoice is issued in a foreign currency other than AED, then the following information should be shown on the invoice.

- The tax amount payable is expressed in AED.

- The applied foreign currency exchange rate is as per the exchange rate published by the UAE central bank on the date of supply of product or service.

- The Total Gross Amount Payable is expressed in AED.

4. Rounding off of Tax Invoice Values

The tax value stated on the tax invoice should be rounded off to the nearest Fils (subdivision of Dirham) on a mathematical basis in accordance with Article 61 of executive regulations.

By rounding the tax value on a mathematical basis, tax should be rounded to the nearest Fils, which are two decimal points.

For Example:

5.357 AED will become 5.36

120. 962 will become 120.96

Why Should One Obtain and Keep Tax Invoices?

The tax invoice is beneficial to the supplier and the customers as they remain valid proof that there existed an official business between the parties over certain goods or services during a particular period.

Some benefits of obtaining and keeping tax invoices are the following

- For the supplier, the tax invoice dictates the time of supply, and he could easily determine the tax period output tax should be calculated.

- For the customer, the receipt of the tax invoice ensures transparency of the VAT amount charged, and it acts as evidence to support the recovery of VAT incurred on purchase as input tax.

- Keep your business organized and professional.

- Enhance the trust of your brand among the customers.

- It helps you to get paid on time without any bargaining.

- Assist the client to recollect the purchase history after some time.

- A crucial element in taxation and legal matters.

Tax Invoice A Good Habit For Financial Discipline

Even though invoices are transformed from printed documents to digital records, the best accounting firms in UAE suggest that the habit of issuing and accepting improves the transparency of the business and indirectly develops financial discipline among the people. When we have a proper record of the money we exchanged, there would not be any unnecessary wastage of wealth to purchase unwanted goods or services. All firms and companies should promote invoices for small-scale to large-scale products to create financial awareness and keep a check on cash flow.

Please contact us for any VAT related services and assistance.

“Disclaimer: The above content provides a general overview based on current UAE tax regulations and is intended for informational purposes only. Tax laws and regulations are subject to change, and their interpretation or application can vary significantly depending on individual circumstances and the nature of the business. Readers are strongly encouraged to seek professional tax and legal advice from a qualified advisor, such as PROFITZ ADVISORY, before making any compliance decisions or relying on this information. The author and publisher bear no responsibility for any actions taken based on this content.”