Corporate Tax Services in Dubai

Corporate Tax

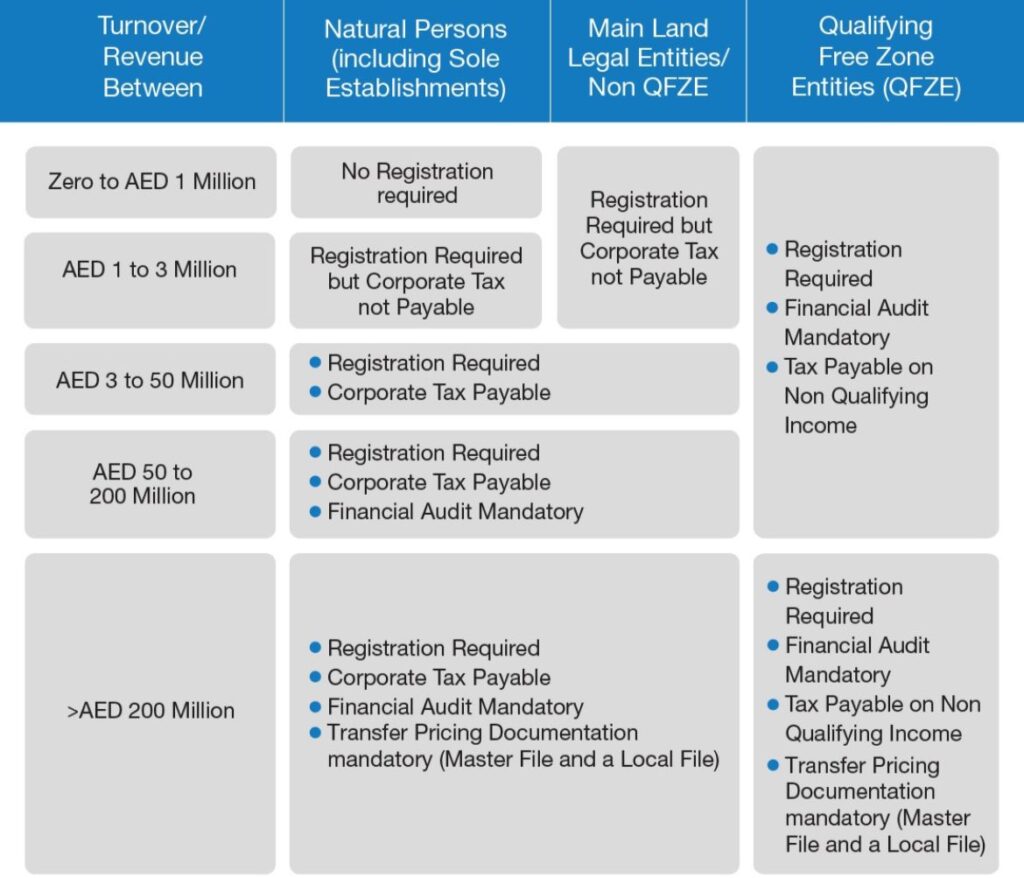

The Ministry of Finance has introduced Federal Corporate Tax on business profits that will be effective for financial years starting on or after 1st June 2023 with a standard statutory tax rate of 9% for taxable profits above AED 375,000. The Corporate Tax of UAE will remain the lowest tax rate in the world, and it reduces the compliance burden on businesses.

We offer the following Corporate Tax advisories for our clients:

- Corporate Tax Registration

- Corporate Tax Amendments

- Corporate Tax Annual Return Filing

- External Audit for Corporate Tax

- Corporate Tax Consultancy

Our accounting firm is comprised of experienced and qualified professional teams, who are dedicated to guide your Corporate Tax Registration and returns on time, make necessary amendments and make sure you meet all the deadlines to avoid any fines or penalties. We ensure to keep track of all the necessary documents and processes as required by the authorities. Corporate Tax services in accounting refer to the specialized services provided by accounting firms to assist corporations and businesses in managing their tax obligations and optimizing their tax strategies. PROFITZ ADVISORY, is one of the top accounting companies in Dubai, it offers comprehensive corporate tax services to support businesses in navigating the complex tax landscape and ensuring compliance with relevant tax laws and regulations. We are providing some Corporate Tax services

Tax Planning and Compliance: PROFITZ ADVISORY assists companies in developing effective tax planning strategies to minimize their tax liabilities while staying compliant with local tax laws. We analyze the financial data, identify tax-saving opportunities, and recommend appropriate tax structures to optimize tax efficiency.

Tax Compliance and Reporting: The accounting company ensures that corporations fulfill their tax compliance requirements by assisting in tax registration, obtaining tax identification numbers, and submitting periodic tax reports. We help clients maintain accurate records and documentation to support their tax positions and assist in responding to tax inquiries or audits, if required.

Tax Advisory and Consultancy: PROFITZ ADVISORY offers expert advice and consultation on various tax-related matters. We stay updated with the latest tax laws and regulations, helping businesses interpret and understand their implications. We assist in resolving complex tax issues, provide guidance on tax-efficient business decisions, and offer insights into potential tax risks and opportunities

Tax Return Preparation: The accounting company prepares reliable and timely tax returns on behalf of our corporate clients. We analyse necessary calculate tax liabilities,financial information, apply deductions and credits, and submit the completed tax returns to the right tax authorities.

Our corporate tax services aim to help businesses in reducinging tax liabilities, maximizing tax savings, ensuring compliance, and optimizing overall tax strategies, all while adhering to the tax laws and regulations in Dubai.

PROFITZ ADVISORY is one of the top accounting company in Dubai , with a team of experienced tax consultants and agents. We use the latest tax software to ensure accurate and timely filing of tax returns. We also offer advisory services to help businesses manage our taxes effectively and minimize tax liabilities.

Questions

Corporate tax is a tax imposed on the profits or income generated by corporations and businesses. It is a direct tax levied by the government on corporate entities.related matters.

Businesses need corporate tax services to ensure compliance with tax laws, reduce tax liabilities,enhance their tax strategies and take advantage of available tax incentives and credits.

Tax return preparation, tax planning, tax advising, compliance and reporting, tax optimization, international tax services, and dispute resolution are just a few of the many company tax services that accounting companies provide.

Corporate tax services can help your business in Dubai by ensuring accurate tax calculations, minimizing tax risks, identifying tax-saving opportunities, navigating the complexities of local tax laws, and representing your business during tax audits or disputes.

Depending on the specific tax laws and the company's fiscal year end, Dubai's corporate tax filing requirment can shift over the years. Businesses must typically submit annual tax returns, although in certain cases, quarterly or semi-annual tax filings may also be needed.

Hiring a top accounting company for corporate tax services in Dubai offers several benefits, such as expert knowledge of local tax laws and regulations, access to tax planning strategies specific to Dubai's business environment, timely and accurate tax compliance, and proactive tax advisory to optimize tax outcomes.

Yes, Dubai has its own tax regulations and considerations. For example, businesses may need to understand the implications of the UAE's value-added tax (VAT) system, free trade zones, tax treaties, and specific industry-related tax incentives available in Dubai.

Yes, corporate tax services help businesses identify legal ways to minimize their tax liabilities. By leveraging available deductions, exemptions, credits, and tax planning strategies, businesses can optimize their tax position while remaining compliant with the law.

When choosing a corporate tax service provider in Dubai, consider factors such as expertise and experience in dealing corporate tax matters, testimonial of clients, reputation, the range of services offered, and their knowledge of local tax laws and regulations.

Corporate tax services can assist with tax planning for future growth of business. We can provide insights into tax implications of expansion, mergers and acquisitions, and other business activities, helping you make informed decisions to optimize tax outcomes.