Time Frame For Recovering Input Tax : VAT Public Clarification

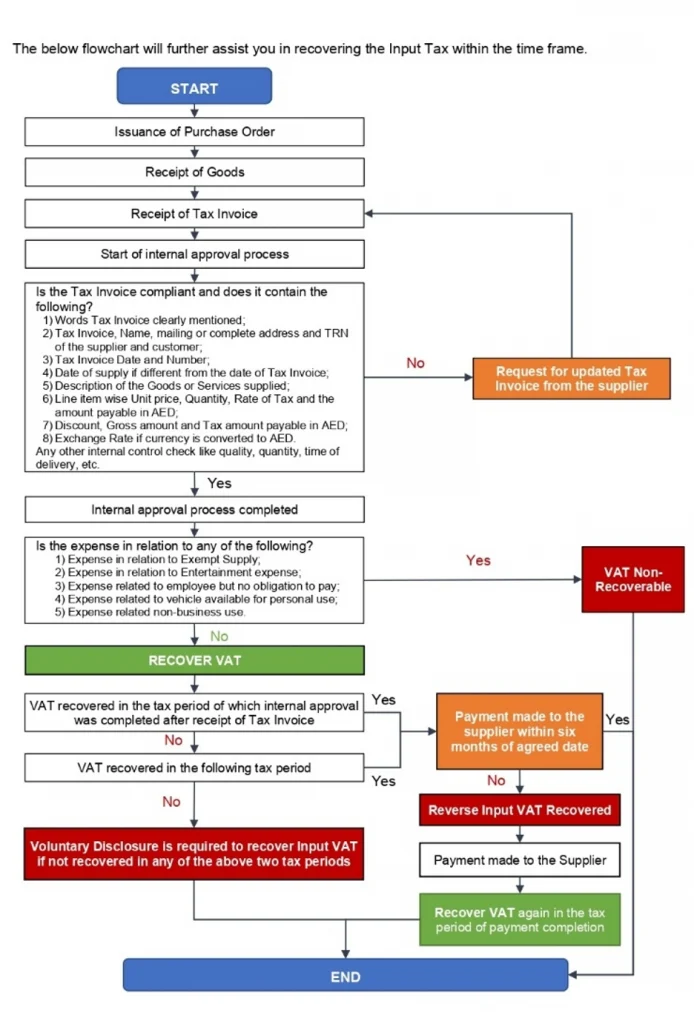

An efficient tax system runs smoothly only if there is a proper time frame for recovering the input tax from the public. The UAE Federal Tax Authority issued a VAT public clarification ( VAT P017) in February 2020, regarding the specified time period for recovering the input tax.

With the public clarification, the authority states that a taxable person shall become eligible to recover input VAT only in the tax period in which he receives a tax invoice, and he has formed an intention to make the payment to the supplier within six months after the expiry of the agreed date of payment.

The input tax that is recoverable by a taxable person for any tax period is the total of input tax paid to goods and services used or intended to be used for making the following.

- Taxable Supplies

- Supplies made outside the state which have been table supplies had they been made in the state.

- Supplies specified in the Executive Regulation of this Decree-Law that are made outside the State would have been treated as exempt had they been made inside the State.

What does the public clarification VAT P017 explain about Input VAT recovery in the UAE?

Many taxable persons faced a challenge in the internal approval process of their supplier invoices completed within the two tax periods of receiving the tax invoice. The FTA has now clarified with new public clarification stating that when a taxable person receives the tax invoice from any supplier, the intention to make the payment against the tax invoice may not be considered to have been established until the internal approval process for an invoice is completed.

The main beneficiaries of this clarification are the industries in construction and infrastructure, which have a long-term approval procedure for supplier invoices that involves consent from different departments within the organization and multiple third parties, including sub-contractors, consultants, and engineers.

Non-payment within six months

If the payment towards the invoice is not made within the time period, then the taxable person should reduce the input tax in the VAT return of the tax period following the expiry of the six-month period to the extent payment is not made.

The Benefits of Public Clarification (VAT P017)

Among the many advantages of public clarification, some of them are the following:

- Input tax that was expensed in the past can be recovered based on the new clarification by filing a voluntary disclosure.

- Track all the tax invoices for which input VAT was reversed and reclaim the input once payment on those invoices has been settled.

- Until the internal invoice approval process, businesses are not recommended to recover input tax on supplier tax invoices.

- During VAT return filing, supplier payment aging reports must be analyzed, and input VAT must be reversed according to the six-month payment condition from the due date.

Taxation Process Become More Transparent

The public clarification on the time frame for recovering input tax helps in replacing unnecessary penalities for delayed recovery of input tax through voluntary disclosures. The easiness of recovering the input tax in the immediate next tax period if the tax is not recovered in the current period is the attraction of new VAT clarification.

Please contact us for any VAT related services and assistance.

“Disclaimer: The above content provides a general overview based on current UAE tax regulations and is intended for informational purposes only. Tax laws and regulations are subject to change, and their interpretation or application can vary significantly depending on individual circumstances and the nature of the business. Readers are strongly encouraged to seek professional tax and legal advice from a qualified advisor, such as PROFITZ ADVISORY, before making any compliance decisions or relying on this information. The author and publisher bear no responsibility for any actions taken based on this content.”